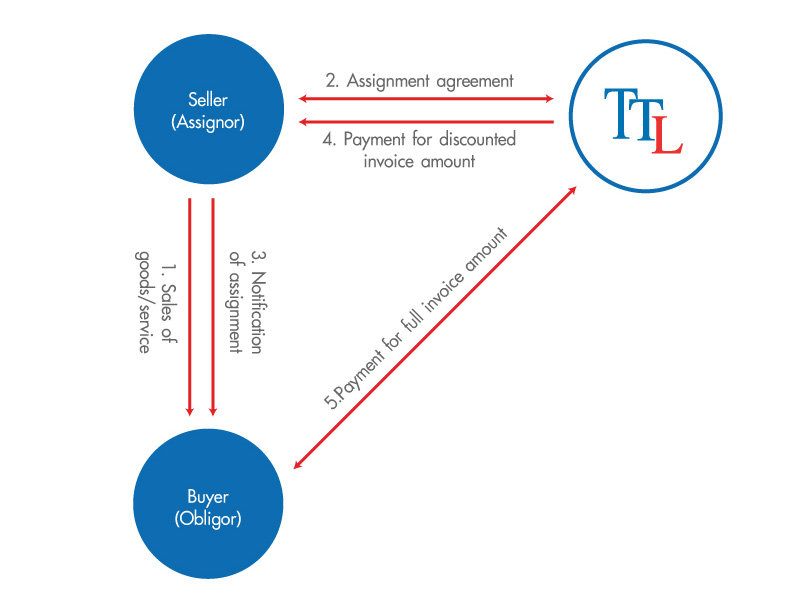

Receivable financing helps clients(sellers) grow its business and effectively support cash flow management. It allows client(Seller) to finance its invoices

to get paid before due date and hedge against credit risks under specified conditions.

1.Recourse/ Seller(Assignor) takes a default risk on buyer(Obligor)

1.1 Direct collection/ TTL collects payment from buyer (Obligor)

1.2 Indirect collection/ Seller (Assignor) collects payment from

buyer in place of TTL and repays the full amount to TTL

in a set period

2.Non-recourse/ TTL(Assignee) takes a default risk on buyer(Obligor), while Seller has no obligation to make up for such default

2.1 Direct collection/ TTL collects payment from buyer (Obligor)

2.2 Indirect collection/ Seller (Assignor) collects payment from buyer in place of TTL and repays the full amount to TTL in a set period